Abstract :

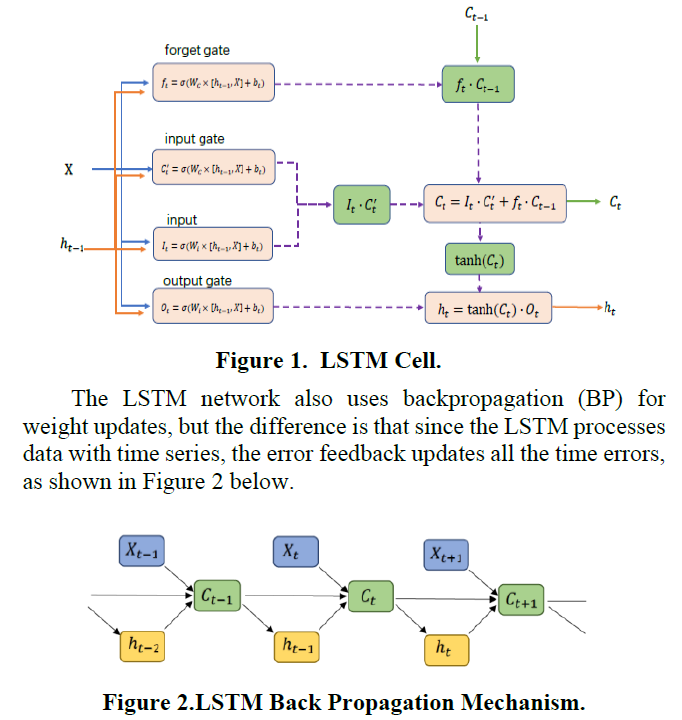

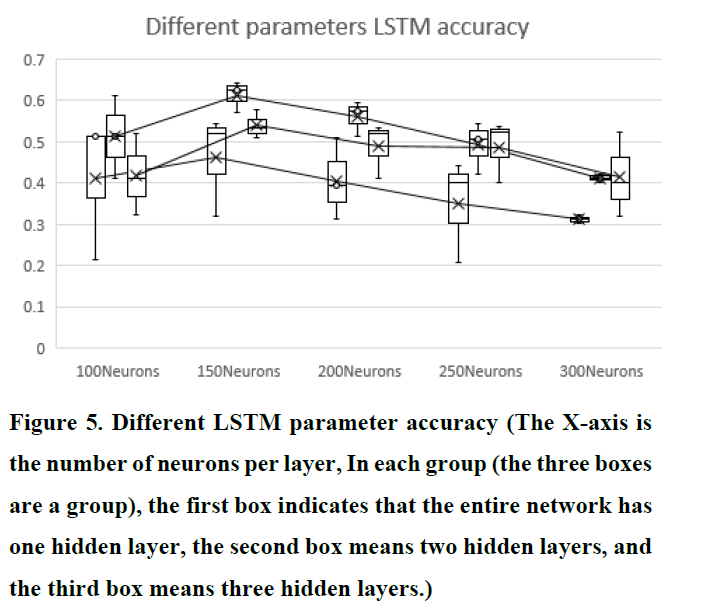

Long-Short Term Memory Network stands out from the financial sector due to its long-term memory predictability, however, the speed of subsequent operations is extremely slow, and the timeliness of the inability to meet market changes has been criticized. In this paper. Aiming at the shortcomings of the slow running of three gates in each neuron of LSTM in back propagation, we1 propose to use GA to optimize the internal weights of LSTM neurons to optimize the defect. In this experiment, GA optimization could not change the accuracy of the model, but it achieved better results than the original LSTM in terms of speed, and satisfied the demand of the future business field for rapid response to market changes in terms of timeliness.

LSTM Architecture :

Results :

Innovation :

This paper proposes a GA optimization method for LSTM neurons. By comparing the running time of predecessor models, it is possible to overcome the shortcomings of slow operation of LSTM to a certain extent by optimizing the internal weight of neurons through GA update.

In addition, this article does not discuss the generalization ability of the network and other parameters of the network at the same time. The research purpose is too single. However, for the short-term prediction of financial markets, the importance of research on the timeliness and advancing of the model is much higher than that of the generalized network model

Publish :

Conference : 2018 2nd International Conference on Deep Learning Technologies

Index : EI Compendex, Scopus

Declaration :

This paper was published a long time ago, and it is not perfect from my current point of view.

-- Moule Lin